In the united states, puerto rico and u.s. In other words, you are admitted to the hospital for an overnight stay.

Hospital Indemnity Insurance East Central Isd

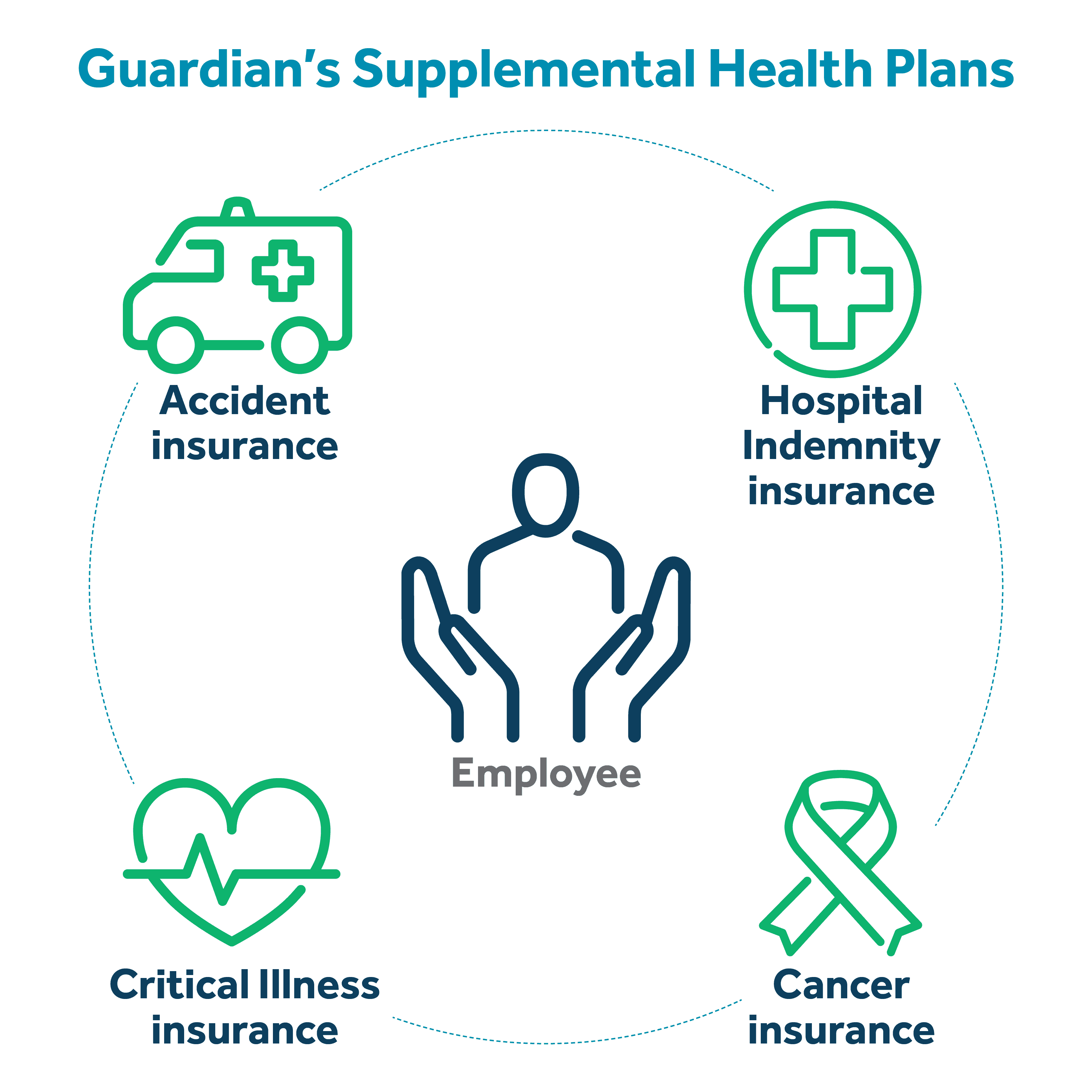

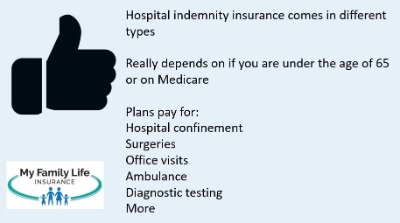

Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for hospital stays.

Hospital indemnity insurance bcbs. For all outpatient and professional medical care, you pay the provider and submit a claim. You can purchase hospital indemnity coverage for yourself and your eligible dependents, which include your spouse and dependent children until their 26th birthday. While every hospital indemnity plan is different, you’ll probably see three core types of benefits especially in group plans offered at work.

And it’s available for companies with as few as two employees. The aflac group supplemental hospital indemnity plan 1 pays $600 amount payable was generated based on benefit amounts for: They usually pay you this daily benefit amount for up to a year.

Our hospital indemnity insurance pays a cash benefit for hospital confinements. Hospital indemnity insurance plans can help you manage those expenses so your savings can be preserved. Protection you can trust with affordable premiums.

The provider files the claim for you. What does a hospital indemnity policy cover?. Insurance is a contract between you and your insurance company.

While medicare may cover some of this, it won’t cover the entire cost. A welcome financial safety net Indemnity plans allow you to direct your own health care and visit almost any doctor or hospital you like.

What does it pay for? This form of supplemental insurance pays you a predetermined benefit amount per day for each hospital confinement. Hospital indemnity insurance is a supplemental medical insurance plan that pays cash directly to you if you have to go to the hospital.

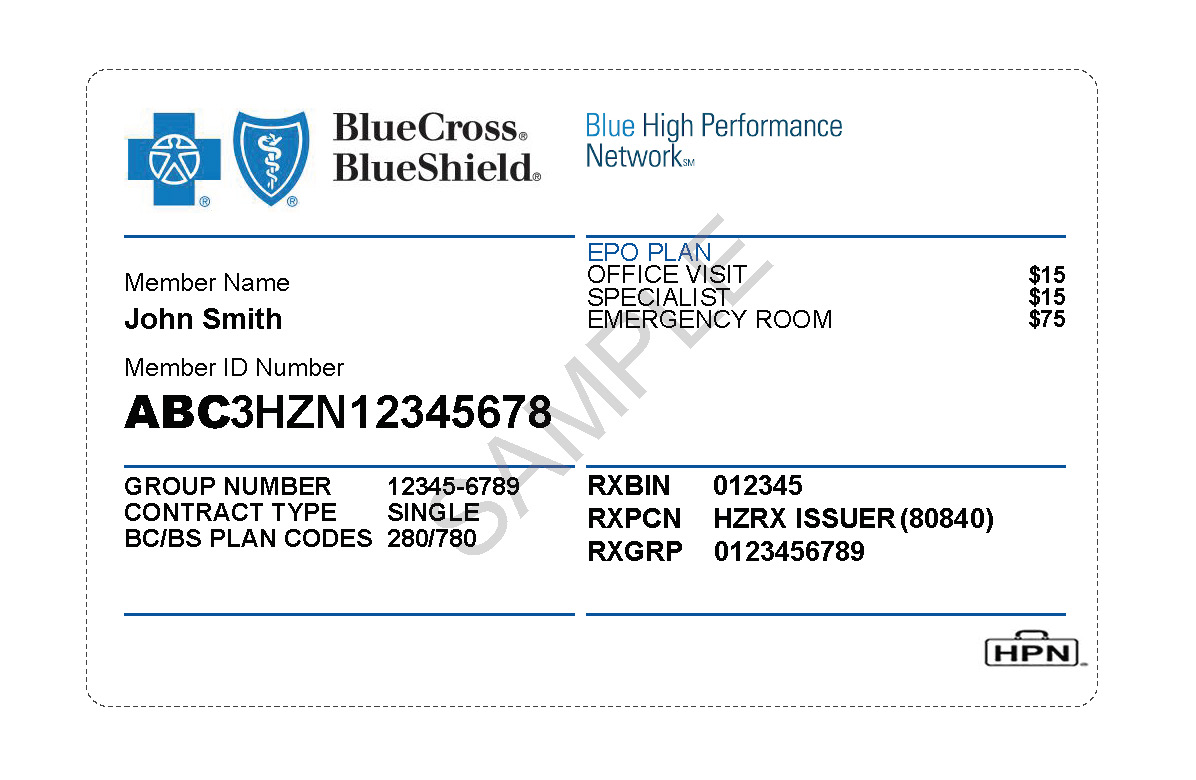

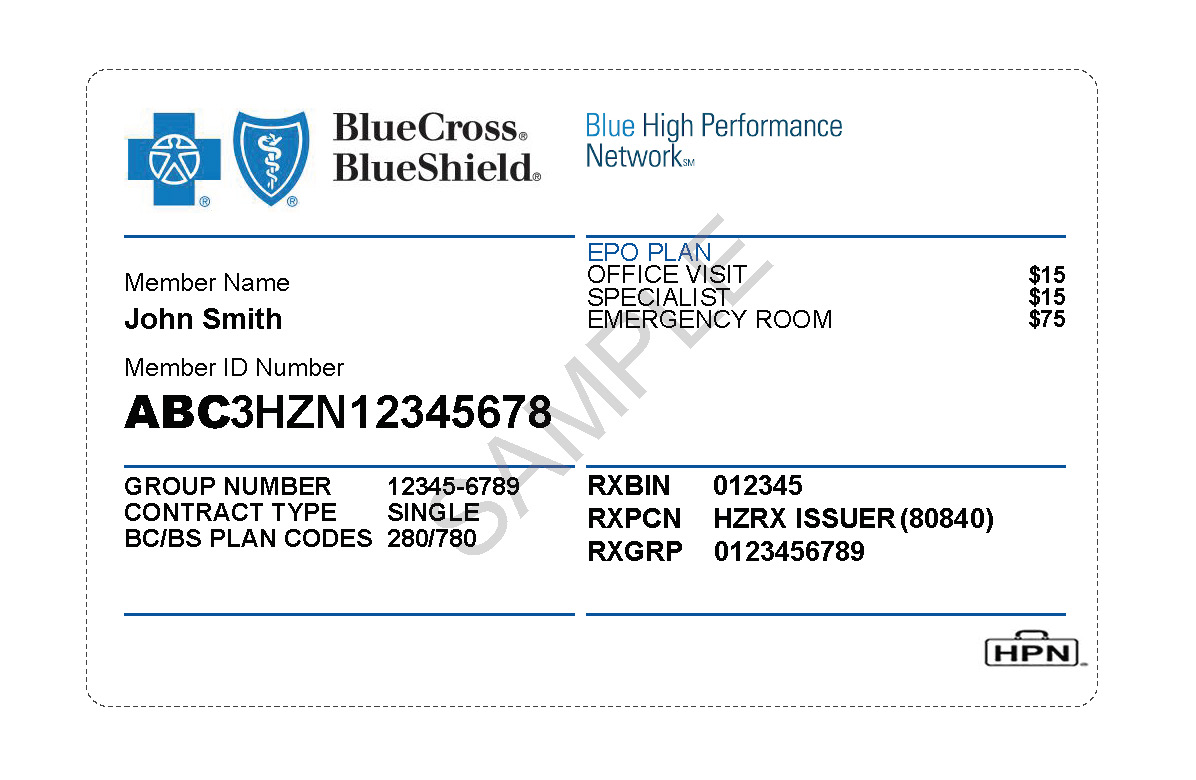

Select blue cross blue shield global™ or geoblue if you have international coverage and need to find care outside the united states. Ad compare top expat health insurance in indonesia. Benefit is payable directly to you and can keep you from withdrawing money from your.

In order to elect the benefit for your dependents, you must also be enrolled. Hospital indemnity plans are especially beneficial for those with high deductible insurance plans. Hospital indemnity insurance is coverage you can add to your existing health insurance plan.

Hospital indemnity insurance can help lower your costs if you have a hospital stay. For each additional night’s stay he can add another $250 on top. Hospital emergency room visit ($50), hospital admission ($250), and hospital confinement ($150 per day).

The average expense for a hospital stay ranges from $9,100 for a medical stay to $22,700 for a surgical stay. United healthcare indemnity united healthcare medicare united healthcare ppo. The plan covers employees who are admitted to a hospital or icu for a covered sickness or injury.

Premiums will be deducted from your paycheck. The cost of coverage can be found in the total rewards café. You are responsible for the timely payment of your account.

Ad compare top expat health insurance in indonesia. Hospital indemnity insurance (also known as hospital confinement insurance or simply hospital insurance) is supplemental medical insurance coverage that pays benefits if you are hospitalized. The insurance company then pays a set portion of your total charges.

Hospital indemnity insurance is a supplemental insurance plan designed to pay for the costs of a hospital admission that may not be covered by other insurance. Depending on the plan, hospital indemnity insurance gives you cash payments to help you pay for the added expenses that may come while you recover. If you don’t go to the hospital, then no benefits are paid.

Get the best quote and save 30% today! Benefits are paid directly to you, or a medical provider that you designate, and are paid in addition to any other health care coverage. Get the best quote and save 30% today!

Search for doctors, hospitals and dentists blue cross blue shield members can search for doctors, hospitals and dentists: What is a hospital indemnity insurance plan? If you're admitted to the hospital for a covered accident or sickness, hospital indemnity insurance plans provide benefits that can help pay for hospital expenses that aren't covered by your health insurance, such as costs related to.

Hospital indemnity insurance helps by putting recovery first over hospital bills.

![]()

Hospital Indemnity Insurance

Making Hospital Indemnity Part Of The Mix

3 Reasons Why Hospital Indemnity Insurance Is Worth It

3 Reasons Why Hospital Indemnity Insurance Is Worth It

![]()

Group Hospital Indemnity - Part-time

Bluecross Blueshield Of North Carolina Medicare Advantage - Tidewater Management Group

Introducing The Blue High Performance Network Hpn Program - Horizon Blue Cross Blue Shield Of New Jersey

Hospital Indemnity Insurance The Hartford

Hospital And Doctor Indemnity Insurance Unitedhealthcare

Insurance Cards Human Resources

3 Reasons Why Hospital Indemnity Insurance Is Worth It

Benefits At A Glance

Provider Communications

Employee Insurance - Gregory-portland Independent School District

2

Appendix 2 Bluecard Program

What Does My Plan Cover - Horizon Blue Cross Blue Shield Of New Jersey

Income Change Blue Cross And Blue Shield Of Kansas

Anthem Specialty Benefit Solutions Supplemental Health Hospital Indemnity

Comments

Post a Comment